Reg. No. 18 18:2-2.7 Abatement of penalty and interest (a) If the failure to pay any tax when due or the failure to file any return is explained to the satisfaction of the Director, he or she may abate the payment of the whole or any part of any penalty and may abate the payment of any interest charge in excess of the rate of one-half of one percent per month from the due date to October 1, 1975, and three-quarters of one percent per month from October 1, 1975 to the date of payment or Decembe.

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

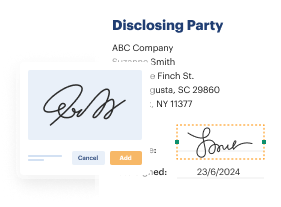

Experience all the benefits of completing and submitting legal forms online. Using our platform submitting Nj Tax Penalty Abatement Letter Sample requires just a few minutes. We make that possible by giving you access to our full-fledged editor capable of changing/fixing a document?s initial textual content, inserting special boxes, and putting your signature on.

Fill out Nj Tax Penalty Abatement Letter Sample within several moments by using the recommendations below:

Send your Nj Tax Penalty Abatement Letter Sample in a digital form right after you finish filling it out. Your data is securely protected, because we adhere to the newest security requirements. Become one of millions of happy customers who are already filling out legal templates right from their apartments.

Put the right document management tools at your fingertips. Complete Irs penalty waiver form with our reliable solution that comes with editing and eSignature functionality>.

If you want to execute and certify Irs penalty waiver form online without any inconvenience, then our online cloud-based option is the way to go. We provide a rich template-based library of ready-to-use forms you can change and complete online. Furthermore, you don't need to print out the document or use third-party solutions to make it fillable. All the necessary tools will be readily available for your use as soon as you open the file in the editor.

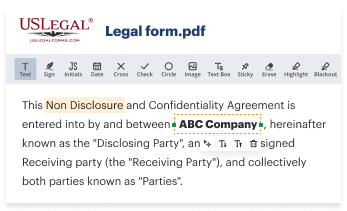

Let’s examine our online editing tools and their main functions. The editor features a self-explanatory interface, so it won't take a lot of time to learn how to use it. We’ll take a look at three main sections that allow you to:

The top toolbar has the tools that help you highlight and blackout text, without graphics and visual aspects (lines, arrows and checkmarks etc.), sign, initialize, date the document, and more.

Use the toolbar on the left if you wish to re-order the document or/and delete pages.

If you want to make the template fillable for others and share it, you can use the tools on the right and add various fillable fields, signature and date, text box, etc.).

Aside from the capabilities mentioned above, you can protect your file with a password, add a watermark, convert the document to the required format, and much more.

Our editor makes completing and certifying the Irs penalty waiver form very simple. It allows you to make just about everything concerning dealing with documents. Moreover, we always ensure that your experience working with documents is secure and compliant with the major regulatory criteria. All these factors make utilizing our solution even more pleasant.

Get Irs penalty waiver form, apply the necessary edits and tweaks, and download it in the preferred file format. Give it a try today!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.